MONTE CARLO ANALYSIS The Tool uses Monte Carlo analysis to generate 1,000 hypothetical market scenarios so that users can analyze hypothetical outcomes for the retirement goal scenario (e. Unlike many retirement calculators, MCRetire takes into account the fact that the return of your investment will fluctuate during the retirement period. The projections and other information you will see here about the likelihood of various outcomes are hypothetical in nature, do not reflect. Monte Carlo Retirement Planning All simple retirement calculators work like the chart below. A simple Monte Carlo simulation in Python.What makes the MC different from a standard retirement calculator is that it adds random fluctuations to a steady growth of the portfolio. Monte Carlo simulation also accounts for the sequence of returns.

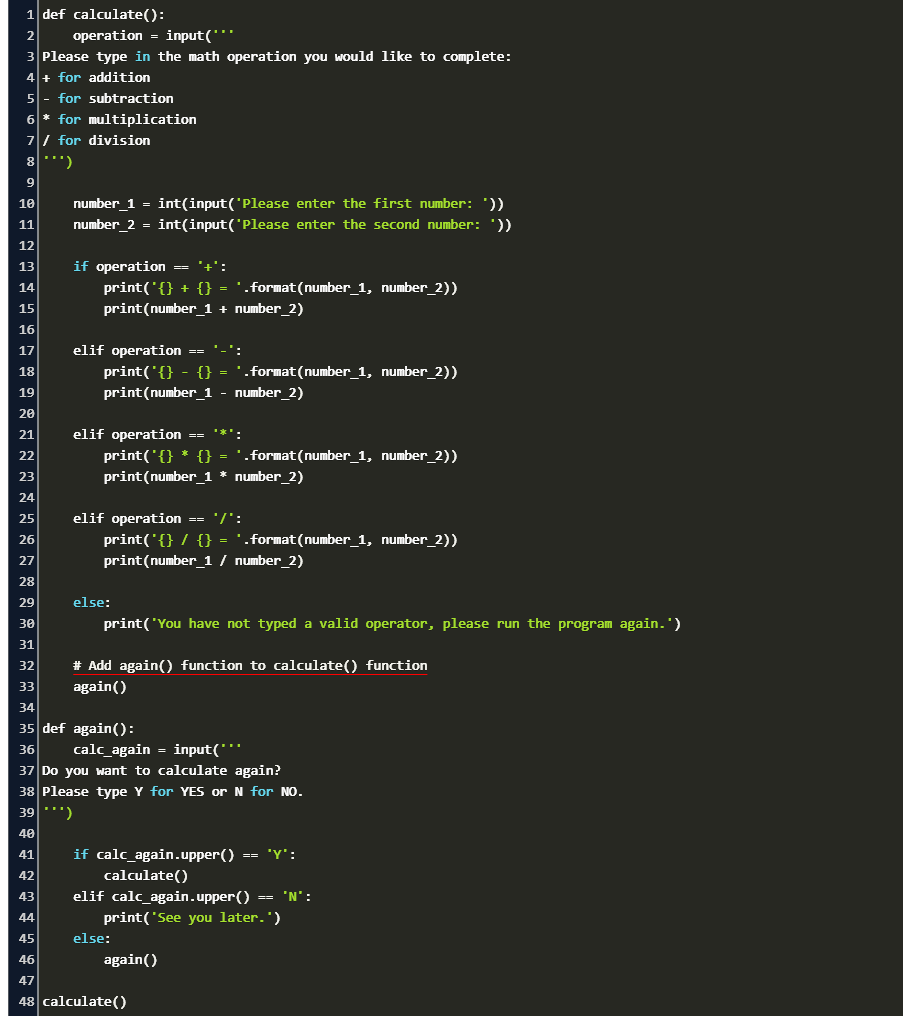

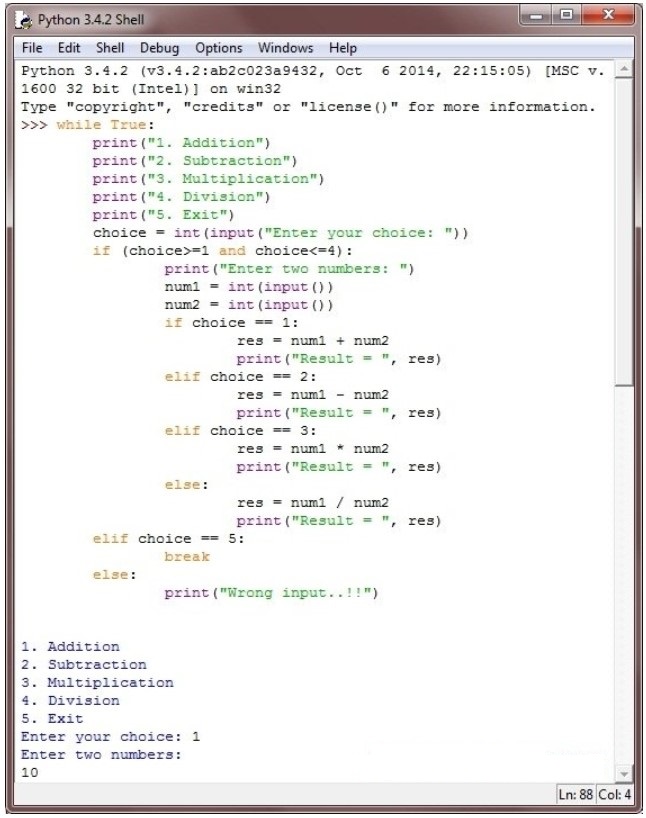

#RETIREMENT CALCULATOR PYTHON PROGRAM CODE#

It’s easy to generalize code to include more financial instruments, supported by QuantLib python Swig interface. Retirement Calculator Python Program Posted on admin Darrow, I think the Fidelity Retirement Income Planner uses Monte Carlo simulation to arrive at an average historical growth rate usually around 8%.

We then generate a large number of random points within the square and count how many fall in the enclosed circle. (Obviously, for a “plan b” you probably want. The Monte Carlo process uses the theory of large numbers and random sampling to approximate values that are very close to the actual solution of the integral.

#RETIREMENT CALCULATOR PYTHON PROGRAM GENERATOR#

A monte carlo generator can also help illustrate the flaws of the gambler's fallacy. Monte Carlo simulation is a technique used to study how a model responds to randomly generated inputs. , testing whether the portfolio can sustain the planned withdrawals required for retirement or by an endowment fund. In retirement income planning, a Monte Carlo analysis can be used to stress-test your retirement plan and see how it would hold up under a random pattern of hypothetical investment returns.

Python monte carlo retirement calculator 5 million in retirement assets and withdraws 4% ($60,000) during the first year of retirement from a portfolio consisting of 50% stocks, 30% bonds, and 20% cash, savings is projected to last 34.

0 kommentar(er)

0 kommentar(er)